The Warren County Treasurer and Collector Office is responsible for administering and collecting the taxes and fees related to Warren County. We work to ensure that all fees and bills are dealt with in compliance with the State of Illinois laws and those set forth by the Warren County board. Additionally, the County Treasurer’s Office provides efficient, courteous service while upholding the fiduciary and statutory responsibilities required of the office. For any inquiries regarding outstanding taxes, tax payment records, or any of the services provided, please feel free to contact our office directly.

Our services include:

Collecting Real Estate taxes

Collecting Mobile Home taxes

Collecting Online tax payments

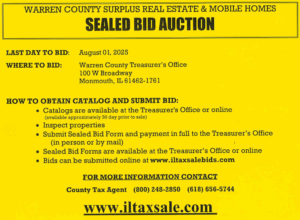

Collecting sealed bid sales

Oversees tax billing and records information

Oversees distribution of Warren County funds

Now accepting Real Estate Tax Prepayments! Contact us!

How to pay Real Estate taxes online!

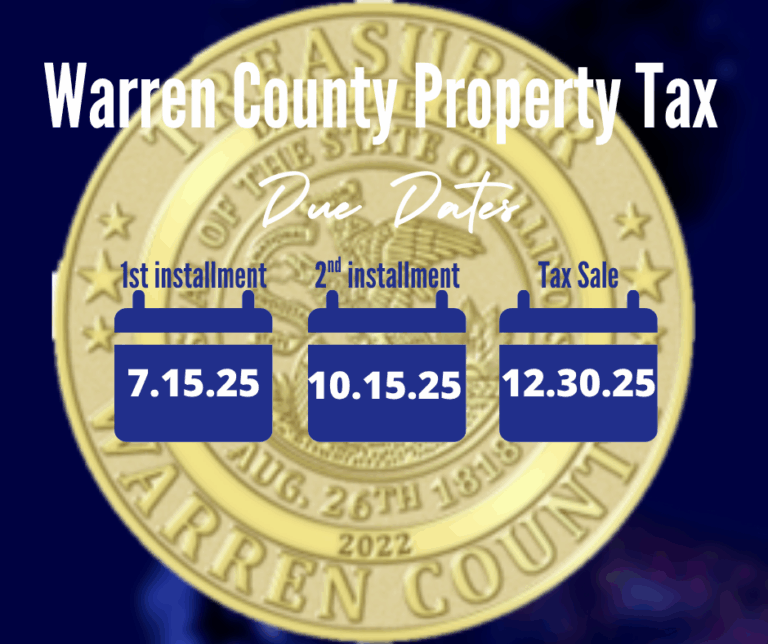

Each year Real Estate tax due dates are planned as close to June 1st and September 1st as possible. Warren County residents may choose to pay their property taxes online by following these directions:

NOTE: There will be a convenience fee charged by GovTechService, Inc. of 2.48% + $1.50

The Warren County Tax Sale is held on the 3rd Monday of October each year. The Warren County Trustee program oversees the sale and purchase of all unsold parcels. All redemptions made after the sale are made directly to the Warren County Clerk’s office.

The Warren County Treasurer’s Office will conduct a Sealed Bid Sale of County Trustee parcels annually. Check with the Treasurer each year for the date. Auction books are available for purchase at the Treasurer’s Office.

PLEASE send your FOIA requests to the appropriate office.

This is the Treasurer & Collector’s Office.

Please direct your FOIA requests to: [email protected]

Instructions for Requesting Information and Public Records

1. Please make your request for records in writing. Warren County does not require the completion of a standard form for this purpose, however

a form is available in the link above for your convenience. To submit the available form electronically you must save it to your computer then e-mail it to the appropriate department below. You may submit your written request by mail, fax, email or in person. If sending your request via email, use FOIA in the subject line to identify your emails as a FOIA request and to reduce the possibility of it being filtered as SPAM.

2. Please be as specific as possible when describing the records you are seeking. Remember, FOIA is designed to allow you to inspect or receive copies of records. It is not designed to require a public body to answer questions. To the extent that you wish to ask questions of a representative of Warren County, please refer to the department list below.

3. Please tell us whether you would like copies of the requested records, or whether you wish to examine the records in person. You have the right to do either.

4. For black and white, letter or legal sized copies, the first 50 pages are free, unless a different fee is otherwise fixed by statute. Any additional pages will be charged at .15 cents per page. Color and abnormal size copies will be charged the actual cost of copying.

5. You are permitted to ask for a waiver of copying fees. To do so, please include the following statement (or a similar statement) in your written FOIA request. “I request a waiver of all fees associated with this request.” In addition, you must include a specific explanation as to why your request for information is in the public interest – not simply your personal interest – and merits a fee waiver.

6. Please include your name, preferred telephone numbers(s), mailing address, and, if you wish, your electronic mail address.

Freedom of Information Act (FOIA) Overview

The purpose of the Freedom of Information Act is to ensure that all persons are entitled to full and complete information regarding the affairs of government, and the official acts and policies of those who represent them as public officials.

The principle mandate of the Act provides that each public body shall make available to any person for inspection, or upon submission of a written request, to provide copies of any requested records that are subject to disclosure under the Act. Not all records are subject to disclosure, and the Act provides a number of exemptions.

This Act is not intended to be used to violate individual privacy, nor for the purpose of furthering a commercial enterprise, or to disrupt the duly-undertaken work of any public body independent of the fulfillment of any of the rights of the people to access to information (5 ILCS 140/1).

Response Time On FOIA Requests

All written requests shall be responded to within five (5) working days (5 ILCS/140/3) following the date the request is received, except in the instance when the request is for commercial purposes. (Within 21 working days of receiving a request for commercial purposes Warren County will: (1) provide a reasonable estimate of time needed to comply with the request along with an estimate of the fees which the requestor will be charged; (2) deny the request pursuant to a statutory exemption; (3) notify the requestor if the request is unduly burdensome and allow the requestor to revise the request to manageable proportions; or (4) provide the requested records). The five (5) day count begins the day after the receipt of the FOIA request by the Department Head or designated department FOIA officer. The requester may be notified of a five (5) day extension (working days) if the files are voluminous, at different locations, or if other reasons make it impossible to assemble and mail the request out within the normal five (5) day period.

Denial of FOIA Requests

All county employees are encouraged to provide available information when requested by the public. Information provided or denied under the FOIA, however, must conform to the legal requirements under the Act. Certain documents may be exempt from disclosure pursuant to specific sections in the Freedom of Information Act (5 ILCS 140/3(g);7;7.5).

When a public body denies a request for public records, that body must, within five (5) working days, or within any extended compliance period provided for in the Act, notify the person who made the request, by letter, of the decision to deny the request. The letter must explain the reasons for the denial, and give the names and titles of all persons responsible for the denial.

Appeal of Denial of FOIA Requests

Any person denied access to inspect or copy any public record for any reason may appeal the denial by sending a written notice of appeal to the Public Access Counselor at the following address:

Public Access Counselor

Office of the Attorney General

500 S. 2nd Street

Springfield, Illinois 62706

Phone: 1-877-299-FOIA (1-877-299-3642)

Fax: 2017-782-1396

E-mail: [email protected]

For additional information regarding the Freedom of Information Act, please visit the Illinois Attorney General’s website http://www.illinoisattorneygeneral.gov/government/idex.html

Proposed resolution and budget amendments for June, 12th 2025 Finance meeting

https://warrencountyil.gov/wp-content/uploads/2025/05/RESOLUTION-CAPITAL-IMPROVEMENT-FUND.docx

Questions? Need Assistance?

Call us at (309) 734-8592 during working hours

The Warren County board and it’s subsidiary offices are committed to the principles of equal opportunity and strictly prohibits discrimination against any person on the basis of age, ancestry, citizenship status, color, creed, ethnicity, gender identity and expression, genetic information, marital status, mental or physical disability, national origin, race, religious affiliation, sex, sexual orientation, or veteran status in its activities, admissions, educational programs, and employment.